Residents of Clark and Washoe counties are concerned about the HOAs super priority status. SGS’s survey in November 2016 showed that 44% of respondents had an unfavorable opinion of HOAs and 29% had a favorable opinion. A later survey in March of 2017, showed that 45% of respondents had an unfavorable opinion of HOAs and 19% had a favorable opinion. Furthermore, 59% of respondents in both the November 2016 and March 2017 surveys think HOAs are more interested in collecting dues than serving their members. On top of that, 77% of respondents in the November 2016 survey oppose HOAs having the power to foreclose on homes over unpaid association dues, but in the March 2017 survey, 81% oppose HOAs having the power to foreclose on homes over unpaid association dues.

44% Unfavorable Opinion of HOAs

29% Favorable Opinion of HOAs

59% HOAs are more interested in dues than members

77% Oppose HOAs having the power to foreclose over unpaid dues

45% Unfavorable Opinion of HOAs

19% Favorable Opinion of HOAs

59% HOAs are more interested in dues than members

81% Oppose HOAs having the power to foreclose over unpaid dues

Beyond the respondents' negative opinion of homeowner associations, federal housing lenders Fannie Mae and Freddie Mac have taken steps in response to super priority liens that could make it harder to receive financing for homes governed by HOAs. The FHFA said that it “has not consented, and will not consent in the future, to the foreclosure or other extinguishment of any Fannie Mae or Freddie Mac lien or other property interest in connection with HOA foreclosures of super priority liens.” SGS’s survey in November 2016 showed that 58% of respondents oppose HOAs super priority lien status because it may make it more difficult for them to receive a loan for a home governed by an HOA. Moreover, 65% of respondents in November 2016 were less likely to support the super priority lien status due to the FHFA’s statement. In March of 2017, respondents were 70% less likely to support the super priority lien status due to the FHFA’s statement.

To further exacerbate matters, a Moody’s Credit Rating report of a residential mortgage-backed security (RMBS) loan portfolio stated that they “further adjusted the loss severity assumption upwards for loans in states that give super priority status to homeowner association (HOA) liens, to account for potential risk of HOA liens trumping a mortgage.” A March 2017 survey showed that respondents were 66% less likely to support the HOA's super priority status because of higher mortgage costs as a result of the increased risk from a lenders point of view due to the HOA's super priority power.

HOA foreclosures in Nevada cause an enormous impact on home values.

In Clark County,

HOA foreclosures sold for a 42% discount with an impact on property sales revenue of $840,115,186.

-$840,115,186

42% Discount

That is nothing compared to Washoe County

where HOA foreclosures sold for a remarkable 90% discount with an impact on property sales revenue of $253,847,824.

90% Discount

-$253,847,824

The disparity between “ordinary” foreclosure sales and HOA foreclosures is just as shocking. An “ordinary” foreclosure sale decreases sale price by roughly 5.26% in Nevada. That is minuscule compared to the 42% discount of HOA foreclosure transactions in Clark County and 90% discount in Washoe County. In Clark County alone, every HOA foreclosure reduces the sale price of every property in the HOA by 1.7%. An SGS survey conducted in March 2017, showed that 81% of respondents opposed HOAs having the power to foreclose on homes over unpaid association dues knowing the large discounts those homes are sold for.

* For detailed calculations please see Appendix III

The LIED Institute for Real Estate Studies at UNLV found that the average house transaction was potentially affected by 0.39 HOA foreclosures and roughly 4.4 “regular” foreclosures. There were 109,692 arms-length transactions from January 1st, 2013 through June 30th, 2016. In all, 611 HOA foreclosures were recorded in Clark County during this period, and 71 in Washoe County.

The LIED Institute’s research shows that investors were either unaware of HOA super priority lien auctions or chose not to pursue them until after the 2014 lawsuit between US Bank v. SFR Investments. Prior to this lawsuit, Assessor records show 10 HOA foreclosures per month in Clark County and roughly 5 per month in Washoe County. After the lawsuit, HOA foreclosures increased considerably. In April of 2014, there were 31 HOA foreclosures, then 44 in May, and a peak of 70 in June of 2014. The number declines after that, and since about December of 2014, HOA foreclosures have settled at around 10 per month, through the end of our database in July of 2016.

HOA foreclosures are highly representative of Las Vegas area properties. The average home transaction has a price of roughly $270,000, has 1,911 square feet of interior area, and has about two and a half baths. On average, these homes were built about 19 years before the transaction. Only 5% have installed security systems, but 48% have a fireplace and 20% have a pool. The average lot size is .14 acres. In Clark County, 57% of homes are part of an HOA. Only 0.5% of listed transactions are HOA foreclosures and 6.5% are other types of foreclosures.

| Variable | Mean | Standard Deviation |

|---|---|---|

| Price | 269,532 | 1,102,35 |

| Square Feet | 1,911.82 | 879.359 |

| Full Baths | 2.187 | 0.604 |

| Half Baths | 0.408 | 0.502 |

| Age | 18.977 | 13.327 |

| Security | 0.053 | 0.223 |

| Fireplace | 0.478 | 0.5 |

| Garage Square Feet | 409.189 | 221.089 |

| Lot Size | 0.137 | 0.146 |

| Pool | 0.2 | 0.4 |

| Condo | 0.97 | 0.296 |

| HOA | 0.567 | 0.496 |

| HOA Foreclosure | 0.005 | 0.068 |

| Other Foreclosure | 0.065 | 0.246 |

| Previous Foreclosures | 4.381 | 9.286 |

| Previous HOA Foreclosures | 0.388 | 1.277 |

Washoe County homes are, on average, more expensive than those in Clark County, with an average price of almost $316,000. They are slightly smaller, at about 1,860 square feet, and have about the same number of baths as in Clark County. They are older - approximately 23 years old at the time of sale. Less than 1% have pools but 65% have fireplaces. Roughly 56% of Reno area properties are in HOAs. Interestingly, about the same percentage of Reno transactions (0.3%) are HOA foreclosures, while the rate of other foreclosures is somewhat less, at 5.9%.

| Variable | Mean | Standard Deviation |

|---|---|---|

| Price | 316,227 | 475,897.2 |

| Square Feet | 1,866.22 | 786.2417 |

| Full Baths | 2.132 | 0.673 |

| Half Baths | 0.316 | 0.475 |

| Age | 23.5 | 19.78 |

| Security | N/A | N/A |

| Fireplace | 0.653 | 0.62 |

| Garage Square Feet | 452.493 | 285.549 |

| Lot Size | 0.406 | 5.402 |

| Pool | 0.008 | 0.089 |

| Condo | 0.179 | 0.383 |

| HOA | 0.563 | 0.496 |

| HOA Foreclosure | 0.003 | 0.054 |

| Other Foreclosure | 0.059 | 0.235 |

| Previous Foreclosures | 1.93 | 4.63 |

| Previous HOA Foreclosures | 0.167 | 0.678 |

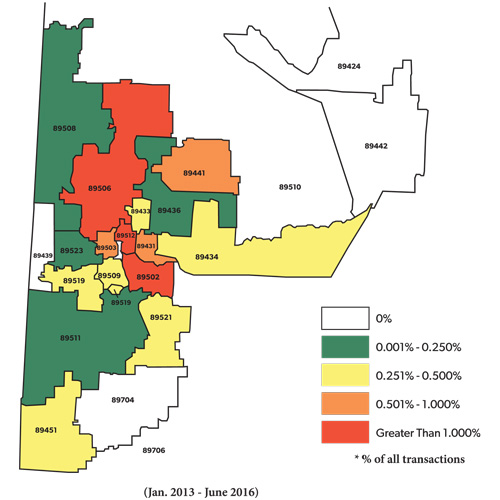

The LIED Institute calculated a “foreclosure discount,” which estimates the total value lost in the housing market. Assessor data shows that the average sale price of an HOA foreclosure is $112,545. If each foreclosure was subject to a 42% discount, the “normal” sale price would have been $194,043. Therefore, across all 611 properties in Clark County, LIED estimates that the total loss to sellers is $49,795,341. As seen in the map below, the overall rate of HOA foreclosures is somewhat concentrated in the central and north central parts of the Las Vegas metro area. The zip codes in the outer ring of suburbs exhibit correspondingly less foreclosures.*

Note that HOA foreclosures in Washoe County are literally pennies on the dollar; the discount is 90%. The average sale price of the 71 HOA foreclosures was $22,728. If each had sold at this same discount, the average sale price would have been $227,280 for a total loss in transacted value of $14,523,192.*

An additional monetary impact is the loss of principal on mortgages. The LIED institute calculated the average amount of principal remaining on HOA foreclosed property loans to be $156,495. Bearing in mind that each step of this calculation is subject to considerable error, the aggregate amount lost by lien holders over the 611 HOA foreclosures is estimated to be $95,618,445 in Clark County alone.*